Prev post

ISO 9001 and Climate Change

Practical Steps for ISO 9001 Certified organisations to comply with inclusion of Climate Change to the ISO 9001:2015 Quality Management System Standard

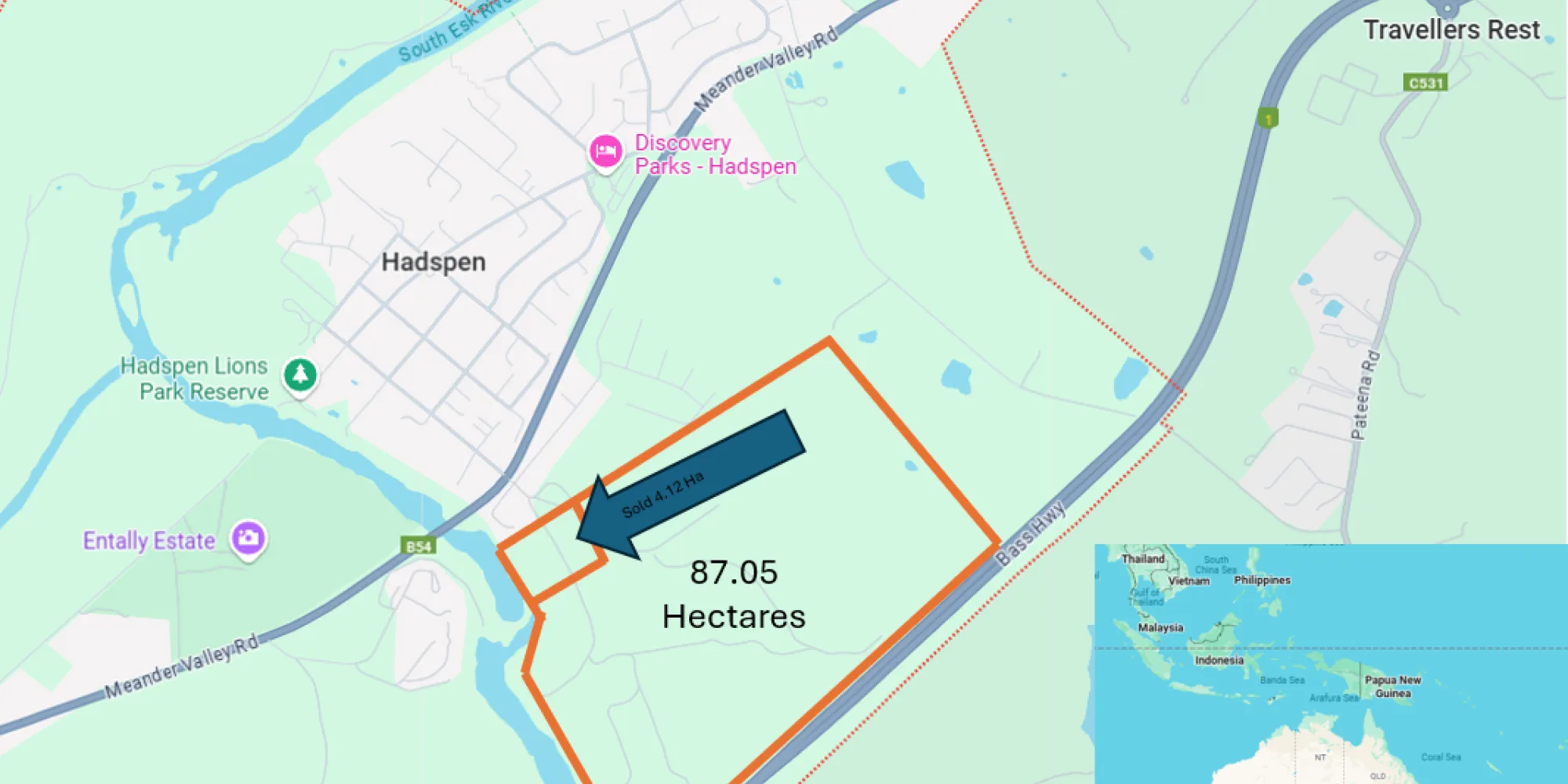

Evahan arranged the sale of a 4.12 hectare parcel of residential zoned land for Bresnehan Family Office company, Coronea.

Posted

On behalf of the Bresnehan Family Office, company, Coronea Pty Ltd Jason Bresnehan:

Prior to agreeing to the sale Evahan prepared a detailed financial model for Coronea comparing the return of developing the 4.21 hectares into a residential subdivision from its own balance sheet (Option 1 - Coronea Develops) versus a clean sale of the parcel (Option 2 - Clean Sale). The financial model comparing the two options was extensive factoring in the cost of money, contingency and risk for Option 1 as well as worst, base and best-case scenario analysis of the development time and residential block sale time.

Project Outcomes

The Bresnehan Family Office achieved the following outcomes:

Looking for property development partner in Tasmania? Contact Jason Bresnehan.

01 September 2025

Evahan recently led a high-impact SWOT workshop for a major Australian supplier of concrete and construction…

27 August 2025

Evahan recently acted as a behind-the-scenes adviser to a member and former trustee of a Self Managed Superannuation…

21 August 2025

Evahan has successfully launched a company-wide Quality Management System (QMS) and Continuous Improvement (CI) Program…